ERP SaaS Trap —

A War Story Every CFO Should Hear

TL;DR Battle Map

-

The Call: Controller phones in—renewal ballooned 60 % after five SaaS years.

-

The Pattern: We crunch numbers; perpetual would save real money, but switching pain stalls action.

-

The Trap: Lower entry cost morphs into forever payments you can’t escape—host controls DB, version, and renewal price.

-

The Lesson: Perpetual + optional maintenance + separate hosting lets you keep cost leverage.

-

The Fix: If you must go SaaS, negotiate seat‑shrink rights, cap renewal hikes, and audit licenses yearly, often not a possible negotiation with SAP.

Real names redacted; lessons intact.

The Calls I Get Every YearMy phone rings. A controller’s voice—tight, frustrated: “We bought 20 seats of an ERP that rhymes with BetSweet five years ago.Functionality is fine, but the renewal quote is killing us. What would SAP B1 cost?”Years ago I’d dive into the numbers, eager to rescue them. Older‑me knows the pattern: the math always proves we could save them money. They almost never switch. Why? They’ve stepped into the SaaS licensing trap.

Meet “Acme Widget Global”

-

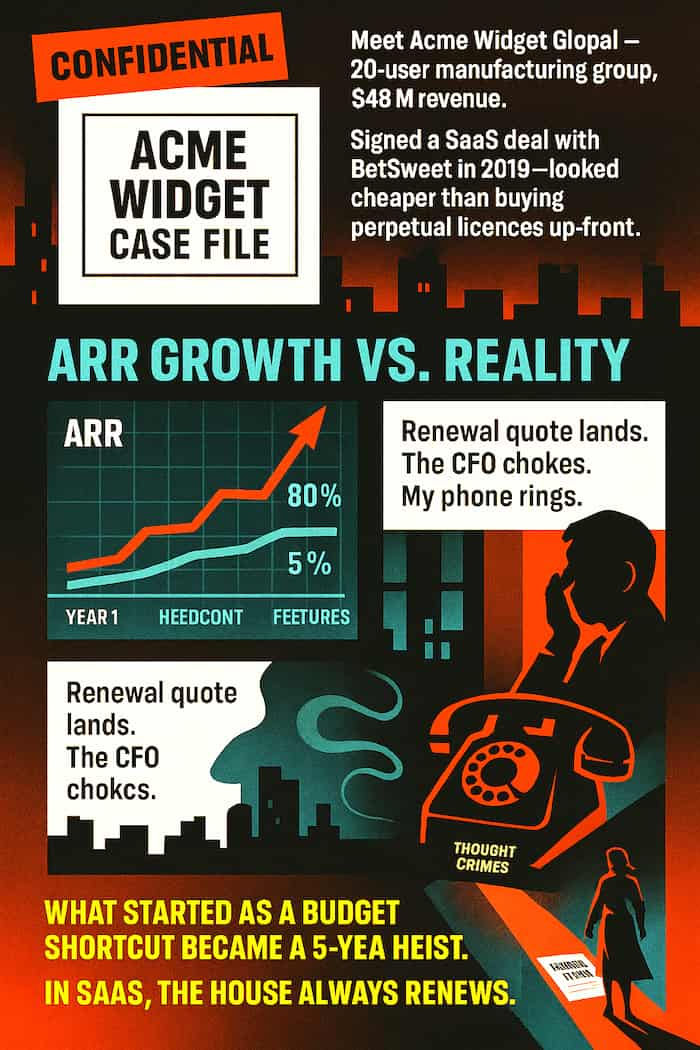

20‑user manufacturing group, $48 M revenue.

-

Signed a SaaS deal with BetSweet in 2019—looked cheaper than buying perpetual licences up‑front.

-

By Year 5 the ARR ballooned 60 %—far outpacing headcount or feature growth.

-

Renewal quote lands; CFO chokes. My phone rings.

BetSweet knew this day would come. It’s not a bug; it’s the business model.

Maybe I'm just the cynical type, but my core belief is that there are no coincidences—only well‑planned events repeated over time.

Insider’s View:

-

Quarter‑end “sweetheart” discounts aren’t gratitude; they’re a calculated land‑grab. Once you’re live, only implementation failure or business failure will break the cycle.

-

Renewal notice is 60 days on purpose; they know an average ERP swap takes 6 months—you have zero credible threat window.

-

The profit they deferred at Day 1 returns with interest each renewal cycle.

A BetSweet user literally told me he sets a calendar alert six months before renewal so they can start begging for concessions.

He told me, “If I wait, we lose every negotiating chip.” Smart tactic—yet exhausting. My question back: Aren’t you tired of the games? Shouldn’t your vendor be invested in your success beyond bleeding your subscription?

How the Squeeze Plays Out

-

Hook: Quarter‑end discount seals the deal.

-

Delay: Two‑month renewal notice vs six‑month migration timeline.

-

Squeeze: Annual hikes outpace value delivered.

-

Trap: Cost to exit dwarfs annual overcharge.

-

Remedy: Pre‑plan licence audits, cap hikes, or own the licences from day one. "

The Calls I Get Every Year

My phone rings. A controller’s voice—tight, frustrated: “We bought 20 seats of an ERP that rhymes with BetSweet five years ago.

Functionality is fine, but the renewal quote is killing us. What would SAP B1 cost?”

Years ago I’d dive into the numbers, eager to rescue them. Older‑me knows the pattern: the math always proves we could save them money. They almost never switch. Why? They’ve stepped into the SaaS licensing trap.

Meet “Acme Widget Global”

-

20‑user manufacturing group, $48 M revenue.

-

Signed a SaaS deal with BetSweet in 2019—looked cheaper than buying perpetual licences up‑front.

-

By Year 5 the ARR ballooned 60 %—far outpacing headcount or feature growth.

-

Renewal quote lands; CFO chokes. My phone rings.

The “Predatory Lending” Moment

No politician calls it out, but the mechanics mirror sub‑prime loans:

-

Lower barrier to entry (cut the down‑payment).

-

Lock‑in once integrated (ERP runs everything; you can’t “turn in the keys”).

-

Raise rates when the customer’s success proves they can pay.

“It’s not like bringing back a leased car—you can’t pay the mileage penalty and drive off in a new model.”

Another Insider Angle: I shake my head every time a self‑proclaimed “professional negotiator” boasts that BetSweet “financed the implementation into one low monthly payment.” Financing without an exit clause isn’t negotiation—it’s indentured servitude. Those payments never end, so you’ve effectively signed the industry’s most expensive implementation tab, stretched over a decade or more. Meanwhile, the sales rep who inked that deal likely framed his bonus cheque.

Why Perpetual Is Still the Stabiliser (Especially in SAP‑Land)

-

Licence cost faces downward pressure—competition keeps list price in check.

-

Maintenance is optional—raise it too high and customers simply freeze versions.

-

Application vs Infrastructure separated—you can price‑shop hosting, hardware, and cloud options line by line

Expert Move: Add financing and you mimic SaaS monthly cash‑flow without locking yourself into a single, opaque “black‑box” bill.

Insider View: Ever walk into a car dealership and notice they steer the conversation away from sticker price and straight to “What can you afford per month?” Same with mortgages—the sales game pivots to the payment, not the principal.

SaaS plays that card perfectly: low monthly/annual payments soothe the finance nerves while disguising lifetime cost and stripping away your agency. Yes, some firms genuinely need the cash‑flow relief—and that’s valid. But the real hitch is what never gets discussed: you hand the vendor control of price escalations and environment options.

It’s a harder pitch to say, “We’ll cut the entry fee, then charge you three times more over the life of the deal, and we’ll raise your rates based on our quota, not your success.” Yet that’s the structure.

If you do a TCO, don’t just tally the payments—add the cost of lost leverage and the premium you’ll pay every time the vendor says,

“That feature lives on our roadmap, at our price.”